The idea of this blog germinates from a fierce and rather enriching debate I was recently engaged in over the subject of assessing equities vis-à-vis quarterly earnings. The argument put forward by the other side was that the concept of ‘profit pool’ (profit of all the firms) is an abstract and is ex-post understanding of affairs. Which means a stock market can’t be assessed without bothering about profits of individual firms. My counter to that was, ‘profit pool’ can rather be assessed basis macro variables and that macro setting of an economy gives a good sense of what lies ahead for profit pool of all the firms. As writing has always helped structure thoughts better, I ended up laying out my core argument and a macro framework to corporate profit growth over an email to this person. I am reproducing the main tenets of my arguments in this blog.

Where do profits come from?

Given that I am a macro investor I look at cues to explain aggregate profits of all firms of the market. Individual firm’s profit is a produce of how well it runs its operations and how it is able to out-compete others in creating good products at low cost with good sales and distribution strategies. Assessing all these parameters is the job of my friends in bottom up investing world. Edifice of my macro-investing is built on their hard-work because it’s important that they do the drudgery of relative valuation of the firms in markets, basis how the ‘total profit pool’ will be distributed amongst the firms.

However, I am more interested in total profit pool because only that determines direction of the broad market. It may surprise some to know that aggregate profits of all firms has little to do with individual firms themselves. Fiscal policies and household savings behavior are key determinants of firms’ profits in short term and investment decisions of household and firms, for long term.

Now whenever I say ‘firms’, it’s about ‘all the firms’ of the country. Household is you & me. Foreigner is another country’ firms and consumers.

Framework of understanding the aggregate profits or profit pool of all the firms:

In a close system, for every-profit, there has to be a loss. I know I know, I am being mercantilist, yes, I have read Adam Smith’s The Wealth of Nations, yet, this is the way it works in accounting which balances all things on both sides. We are going to get to ‘the profit equation’ through accounting/flow framework.

The Kalecki-Levy profits equation gives us a good sense of how profits are generated (Levy’s paper is a brilliant read: https://www.levyforecast.com/core/wp-content/uploads/2016/05/levy-forecasting-where-profits-come-from.pdf?834430). I also recommend a book by him to gain better insight in this process. Profits and the Future of American Society: Levy, Jay: 9780451622907: Amazon.com: Books

Now the key objective of this exercise is to get to profits of all the firms. The method is simple. We will look at all the inflow and outflow of the firms. The difference between them is retained by the firms and is called: Profit!

Lets understand how:

Investments & inventory: When a firm buys INR 300 machine, it’s basically an inflow (or income) for another firm which sells it. But for the buying firm, it’s not a cost. It’s an investment. It becomes a cost very slowly as machine depreciates. So for the two firms together, decision of a firm to buy a machine from another firm becomes profit. Magic, isn’t it? This is the reason we all hail investments. If we have lots of investments in our country, there will be lots of profit.

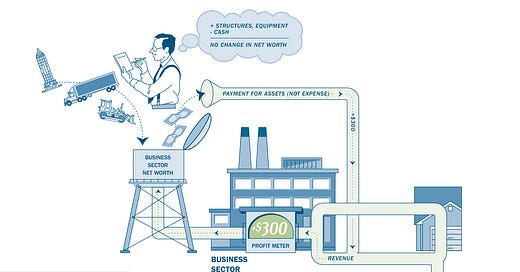

How to read the above graphic? A firm bought $300 worth of machine from another firm. Payment for it isn’t an expense as it’s an investment whereas the one who sells considers this a revenue. Same mechanism for inventory.

Household (HH) savings: Households earn income from firms as salaries or earn profit from their own shops. They spend some of this income and save the rest. Their spending is an income to firms. So bear this in mind. Household saving isn’t a good thing for firms. More they save, worse is the income for firms. So as a stock market investor, I want you to spend everything that you earn. As a friend, I will advise you to save lots!

Now some paradoxical results of this mechanism. Cutting employee salaries doesn’t increase the total profit of the firms. Why? Because salary and spending are related. You cut my salary, my spending will come down. So next time you hear salary cuts by firms, don’t celebrate it as stock market investor. Similarly, interest rates don’t matter because firm’s interest payment is an earning for household.

These days you hear a lot about HH savings. Developed countries HHs are sitting on 5 trillion-dollar extra savings (vs Pre-Covid). Why didn’t it hurt profit of firms? That’s because, this excess savings came from govt transfers. A Median guy in western countries earned more during lockdown due to govt handouts, so he happily saved some of it. Good news is that most of these savings will be spent eventually and will become profits of the firms. That’s why I am not too worried about fiscal contraction in US and Europe. But for India and many other emerging markets, it was different. Govt wasn’t as generous. So savings did not go up much.

How to read the above graphic? A firm paid $1000 worth of salary to its employees (Household). Of that, HH spent $940. Therefore, profit to firm is -$60.

Government: Some of the Government expense may go to Households (HH) and some other may go to firms. Most of HH money is also spent in the manner we discussed above. So lots of Govt spending leads to increase in profit of the firm. The reason why profits soared in past 12 months, was because Government spending increased dramatically across major countries. But during 18m, tax income of the Govt came down sharply but spending still went up! The difference between govt spending and income is called Fiscal deficit. More the fiscal deficit, more the profit of the firms! Remember this. Govt spending doesn’t matter for profit, if its coming from higher taxes. What matters is how ‘imprudent’ govt is in spending more than its income.

Keep this framework in mind now. Next time you hear big spending plan in our economy or US or Europe or China, without increasing the taxes- Go buy equities!

An interesting question is whether cut in corporate tax is a boon for corporate profits. This one seems obvious but not so. The taxes paid by the firms don’t matter for profit because they all circle back to them as revenues (routed through household). What matters is whether the tax cut leads to more fiscal deficit or not?

How to read the above graphic? Government receives $20 from a firm and $115 from HH as taxes. It pays $150 as salaries to govt employees and buys $50 worth of stuff from a firm. So net flow is $65 for the firm. Remember that almost all the fiscal deficit ends up being profit to firms.

Foreigners: This is the last leg and an important one to understand. Current account surplus (Total Exports – Import) is a net income of the country. If imports are higher than exports, we call it current account deficit. That’s a transfer of income to rest of the world. Think of it like this: if household savings rates, corporate investments and government fiscal deficit remain same while current account deficit goes up, it means that the local profit pool will shrink to that extent. Where will it go? It will go to foreign firms. Keep this framework in mind while you analyze the profit growth of 2011-14 in India, as CAD went up, profit to GDP went down. Hypothetically, our firms profit ended up with Chinese firms because our import from China shot up during that time.

(Infographic Source: https://www.levyforecast.com/)

By now, you may be tempted to think that lots of spending by Govt may be a panacea for firm’s profit. Not always. If our govt suddenly increases fiscal deficit by transferring to us lots of money, and we might rush to buy Chinese mobiles, resulting in Chinese firms profit. Not ours. So the way to use this framework is to first understand how firms interact with each of the other stakeholders individually (Firms, govt, HH and foreigners ) and then build a mental model in which we assess how the cumulative effect will work out. Lets build the profit equation to get a full picture:

Finally, The Profit Equation:

Now we know that in our macro set up, firms pay taxes to Govt, buys machines & inventories from other firms, gives wages & dividends to households and earn income from selling goods to households and Govt. The net of all these flows is profit to the firm. Remember, we got here through accounting of all inflows and outflows. This isn’t a theoretical exercise. It truly works. This exercise gives you pretty much ‘total profits’ that ‘all firms in the economy’ report year after year. So here is our final profit equation:

Profits before taxes = Investment - Household Savings + Fiscal deficit – Current Account Deficit

You can derive similar conclusion by doing something simpler as long as you are ready to start with this simple equation in any economy:

Savings = Investment

Since ‘Savings’ is made up of four components (Household Savings + Corporate Savings + Government Savings + Foreigners Savings)

And Corporate Savings = Corporate Profit – Dividends

Therefore, Corporate Profit = Investment + Dividends – Household Savings – Government Savings –Foreigners Savings. Same conclusion!

Please remember that Investment here is made up of both household and corporate investments. Most of the of the household investment is in houses. Also, just for simplicity I didn’t add inventory and dividend in the profit equation. But you get the idea. Inventory behaves like investment and Dividend like household income.

Let’s keep this framework in mind in assessing how Indian profit cycle will evolve in medium term.

A little bit of history of corporate profit in India: Overall corporate profits are in 8-10% of GDP over last 15 years’ vs 4-5% in the previous 15 years. Though overall profit to GDP hasn’t moved much over past 5-7 years but listed firms profit has fallen as % of GDP. Therefore, unlisted firms gained at the cost of listed ones.

Even within listed universe there are divergent trends. Top 500’s share rose at the cost of rest of the listed firms but fell as a % of GDP. So what’s playing out in India? One, the belief that India has had ‘profit less’ growth isn’t true. It’s just that lots of profit is going to unlisted firms. Two, there isn’t much of formalization story playing out, as is often told to us. A simple ‘oligopolistic trend’ is what I see in some industries. Small number of metals, cements, infra, banks, telecom, auto firms are gaining profit share at the cost of other listed firms. But in aggregate, to repeat the same point, all the listed firms are losing ‘profit share’ to unlisted firms. Three, its not that mom & pop stores are making lots of money when we say that un-listed firms are gaining. They too seem to be losing. That’s what most national surveys tell us. Then who is gaining? I have some ideas of it. We will speculate on it some other time!

Using the profit equation to understand the profit drought of 2012-18: During this period fiscal deficit fell from 7% (12m trailing, in Dec-11) to less than 3.5% (12m trailing, in April-18). This became a drag for profits. Typically, after slowdowns, investment picks up again. But that never happened in India. Since 2013, Investment has been on a downhill. Firms investments have languished though we have seen some intermittent growth there. But household investments have slowed almost secularly.

Remember that in our profit equation, both HH investment and Firms investment matter for profit. Firms investments may have suffered from overcapacity in the beginning of the decade and then came the NPA mess. Don’t solve NPA mess fast, you will always have investment slowdown, is a time tested thesis, across countries. This has been understood by us in both 1999-03 and 2015-19 slowdown.

But what has puzzled everyone is the slowdown in household investment. Why did Indians suddenly go-slow on building houses or setting up small firms to cater to local markets? It could have been to do with real estate bubble that made houses too expensive or job-less growth. Or was it Demon and GST combined that took away the comparative advantage of low/no taxes that small firms enjoyed. Whatever it was, this remains the number one policy-priority for the govt & RBI to get household build houses again and get the cheap-enough credit flowing again to compensate for ‘tax loss’. Without that, its difficult to imagine good growth in near term. For the limited purpose of this note, the conclusion is simple: we cant have profit growth without lots of investments by both household and firms!

This is the framework I was using in expecting muted single digit earnings growth back in 2015-16 when popular view was of 15% profit growth. Refer: Corporate earnings reset in line with nominal growth rate: Maneesh Dangi (livemint.com).

The profit boom of 2021-22 and a cliff after this: Our listed firms cut expenses sharply resulting in higher profit, while their sales declined more than nominal GDP decline (-6% vs -3%). If you use the profit equation, it shows that the rise of fiscal deficit from 5% to 9% and current account movement from deficit of 1% to surplus of +1%. Together, this seems to explain the profit boom of firms. But once we look beneath the surface, something more sinister happened. Aggregate profit of all the firms fell from near 10% to 8.5% of GDP, whereas listed firms witnessed a sharp rise from 2% to 3%. Unlike in the west, where profit boom can be explained by income transfer from Government to firms, in India’s case it became zero sum income transfer from unlisted to listed corporate entities.

Now, it’s important to recognize that what happened last year isn’t a repeatable sequence. Let’s do a small iteration of ‘The Profit Equation’ to assess the future. Given that dividend is an outcome of profit, let’s ignore it. Our fiscal deficit will reduce by 2-3% over next 3 years. Our current account deficit (CAD) is too depressed and is likely to go up by 1-1.5% over next 2-3 years, reverting to pre-pandemic levels. So both Fiscal deficit and CAD will be drags on our firms’ profits pool. Profit growth in this environment can only happen if corporate and household investments rise. We need to sight investment intentions of corporate to expand capacities and household’ confidence in building houses and local businesses. These two are the important markers of firms profit. Unfortunately, both are not looking very good at the moment. But I am hoping that it will change soon.

Key take away for you is that current profits are produce of past macro-economic set up. Things that have little to do with firms, matter more for their profits. We are well fed by the bottom up investing world on how most future profits are bootstrapped from current profit and near term guidance by the management. I think macro investing framework can help us understand the firms ‘profit pool’ better. Doing that can also help us catch both major and mini-profit cycles. Let’s begin this journey of understanding the macro signals which will tell you probable EPS of NIFTY50 in FY24-25. We have a framework now. On exact macro signals, next time then!

Maneesh Dangi, August 13, 2021

Thankyou sir. Amazing piece. If the CAD rises (profit eq), simultaneously capital account surplus should rise to fund it. FDI, ECB, remittance, FPI flows should rise to fund the CAD which I think is captured in investments in your profit eq, this will lead to overall increase in PBT in your eq. If we rush to buy Chinese mobile devices when fiscal deficit rises, probably listed domestic mobile firm loses market share but ancillaries benefit around the Chinese mobile imports such as truckers, retail outlet selling mobile device, land lord of the facility, sales man, technician providing support. In a nut shell ideally PBT should rise even if CAD rises on back of higher fiscal deficit.

I also believe primary deficit captures real spending of any Sovereign because generally fiscal deficit does not exclude Interest payment on government debt. Government of India has run fiscal deficit ~3.5% (average of last 5 years) but average primary deficit number of last 5 years is ~0.4%.

Budget 2020-21 is the first year in last 20 years when government of India ran highest ever primary deficit of 5.9%. A lot of it went into food and fertilizer subsidy but spending is spending. One persons spending is some one else's income.

Thanks Maneesh , simplification at its best as always . Investment and savings will be the biggest factors and most important part remains the movement from unorganised to organised for stock market .